How do I complete a month-end close?

This FAQ article will assist you in performing the steps necessary to close a Fiscal Period. Fiscal Periods represent budgetary or accounting periods that fall within Fiscal Years. These often match the calendar where there are 12 periods, matching the calendar months. In organization where the fiscal year does not match the calendar year, Fiscal Periods may or may not match the number of days in a calendar month. Every transaction that posts to the general ledger contains a 'GL Date' and that date identifies both the Fiscal Year and Fiscal Period the transaction was posted to the general ledger in.

![]() The steps outlined in this article must be performed for each NorthScope Company.

The steps outlined in this article must be performed for each NorthScope Company.

SUMMARY OF THE STEPS

Open the next Fiscal Period

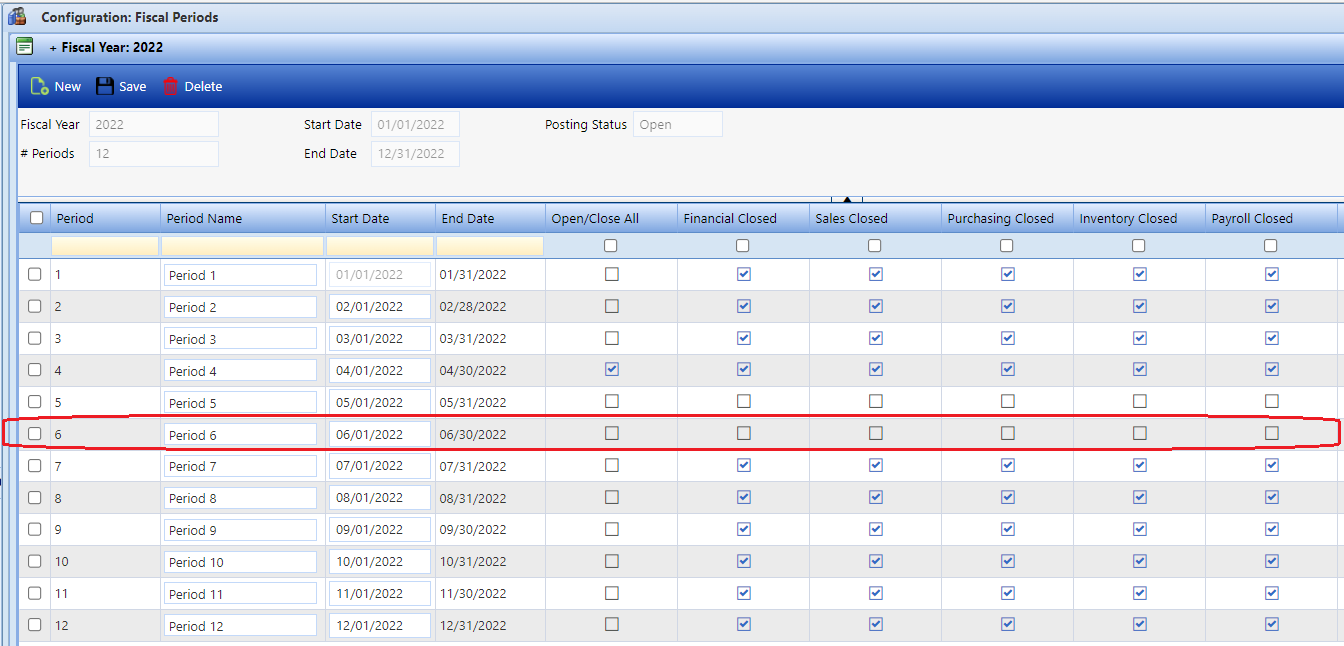

On or before the first day of a new Fiscal Period, the Fiscal Period must be "opened" by navigating to the Fiscal Year Record View and unchecking the 'Closed' checkboxes for the appropriate GL Period row (see image 1). Transactions with any 'GL Date' can be entered and saved but only transactions with a 'GL Date' within an open Fiscal Period can be 'Approved' or 'Posted'. This can be done by navigating to Financial → Configuration → Fiscal Periods and selecting the appropriate Fiscal Year page.

Image 1

Ensure all transactions for the month you are closing are posted

This step ensures that all transactions for the Fiscal Period you are closing, are posted. Depending on which Functional Areas are licensed or used, this step may need to be done in the sequence show below. The list below contains all the NorthScope Functional Areas, but those not in use can be skipped. Some of the steps shown may not be required to close NorthScope but should be reviewed as a matter of good housekeeping.

| Functional Area | Transactions | Navigate to | Comment |

|---|---|---|---|

Company | Transactions being imported into NorthScope. | Company → Integration → Inbound Integration | Search for transactions with errors. Stuck transactions for the period you are closing must be resolved before continuing. |

| Transactions being exported to other systems. | Company → Integration → Outbound Integration | Search for transactions with errors. Stuck transactions for the period you are closing should be resolved before continuing. These may not impact your NorthScope close but could impact the destination system. | |

Fisherman Accounting | Fish Tickets | Fisherman Accounting → Fish Tickets | Find and post any open transactions that fall withing the Fiscal Period being closed. |

| Fisherman Sales / Tender Resales | Fisherman Accounting → Fisherman Sales | Find and post any open transactions that fall withing the Fiscal Period being closed. | |

| Fisherman Adjustments | Fisherman Accounting → Other Transactions | Find and post any open transactions that fall withing the Fiscal Period being closed. | |

| Fisherman Balance Transfers | Find and post any open transactions that fall withing the Fiscal Period being closed. | ||

| Fisherman Payment Receipts | Find and post any open transactions that fall withing the Fiscal Period being closed. | ||

| Process Payments | Fisherman Accounting → Fisherman Balances → More Actions → Process Payments. Click in the Batch ID lookup. | Find and either post or void any open payment batches that fall withing the Fiscal Period being closed. | |

Apply Documents | Fisherman Accounting → Fisherman Balances → More Actions → Apply Documents. | This is only necessary for companies that manually apply fisherman transactions. | |

| Fisherman Accounting → Fisherman Balances → Mass Update → FIFO Apply Fisherman Transactions | |||

| Grower Accounting | Grower Tickets | Grower Accounting → Tickets | Find and post any open transactions that fall withing the Fiscal Period being closed. |

| Load Management | Loads | Load Management → Loads | Ship any Loads that have physically shipped. This is necessary to post the Sales Orders. |

Sales Programs | Brokerage Programs | Sales Programs → Program Balances → Process Settlements For → Brokerage | Ensure that all the Brokerage Programs have been processed and that all the Batches have been posted. |

| Rebate Programs | Sales Programs → Program Balances → Process Settlements For → Rebates | Ensure that all the Rebate Programs have been processed and that all the Batches have been posted. | |

| Off Book Programs | Sales Programs → Program Balances → Process Settlements For → Off Book | Ensure that all the Off Book Programs have been processed and that all the Batches have been posted. | |

Purchasing | Invoices/Credit Memos | Purchasing → Invoices | Find and post any open transactions that fall withing the Fiscal Period being closed. |

| Purchase Orders | Purchasing → Purchase Orders | Find and close any Purchase Orders that should be closed. This will not impact your month-end close but is a housekeeping step that should be done. | |

| Process Payments | Purchasing → Vendor Balances → Build Payment Batch | Open the page and ensure there are no Batch IDs that should be Processed. | |

| Purchasing → Vendor Balances → Process payments | Open the page and ensure there are no Batch IDs that should be Processed. | ||

| Apply Documents | Purchasing → Vendor Balances → Apply Payables Documents | This step can be skipped if there are no totals in either the 'Unapplied Payments' or 'Unapplied Credits' columns of the Vendor Balances page. | |

Inventory | Transactions | Inventory → Transactions | Find and post any open Adjustment, Production, Receipt, Transfer, or Transfer Receipt transactions that fall withing the Fiscal Period being closed. |

| Production Orders | Inventory → Production Orders | Find and close any Production Orders that should be closed. This will not impact your month-end close but is a housekeeping step that should be done. | |

| Cycle Count | Inventory → Cycle Count | Find and post any open Cycle Counts that fall withing the Fiscal Period being closed. | |

Sales | Sales Orders, Price Adjustments, and Returns | Sales → Transactions → Sales Transactions | Find and post any open Sales Orders, Price Adjustments, or Returns that fall withing the Fiscal Period being closed. |

| Quick Sales | Sales → Quick Sales | Find and post any open transactions that fall withing the Fiscal Period being closed. | |

| Payment Receipts | Sales → Payment Receipts | Find and post any open transactions that fall withing the Fiscal Period being closed. | |

| Apply Documents | This step can be skipped if there are no totals in either the 'Unapplied Receipts' or 'Unapplied Credits/Returns' columns of the Customer Balances page. | ||

Financial | Journal Entries | Financial → Journal Entries | Ensure all the manual, accrue & Reverse, and or imported journal entries that fall withing the Fiscal Period being closed have been entered and posted. |

| Checkbook Transactions | Financial → Checkbook Transactions | Ensure all the Deposits, Checkbook Adjustments, and Checkbook Transfers that fall withing the Fiscal Period being closed have been entered and posted. | |

| Checkbook Reconciliations | Financial → Checkbook Reconciliations | Ensure all the Checkbook Reconciliations that fall withing the Fiscal Period being closed have been entered and posted. | |

| ACH Batches | Financial → Inquiries → ACH Batch Inquiry | Find and submit any ACH Batch files that have not been submitted to the bank. This will not impact your month-end close but is a housekeeping step that should be done. |

Ensure the balances for all Control Accounts match their corresponding Subsidiary Ledgers

This step ensures all your Control Accounts tie out to their respective sub-ledgers. A Control Account is a general ledger account containing only summary amounts. The details for control accounts are stored in a separate but related subsidiary ledger. The subsidiary ledger allows for tracking transactions within the control account in more detail. Individual transactions are posted both to the control account and the corresponding subsidiary ledger, and the totals for both are compared when preparing a trial balance to ensure accuracy. Control Accounts keep the general ledger free of details, while still maintaining correct balance for preparing the company's financial statements. The most common examples of Control Accounts include Accounts Receivable and Accounts Payable. The List of Control Account Types include:

Although nothing will prevent you from closing a Fiscal Period with one or more out-of-balance Control Accounts, you should not close a Fiscal Period if any of them are out-of-balance with their subsidiaries. The list below contains all the NorthScope Control Accounts, but those not in use can be skipped.

| Control Account | Trial Balance Account(s) | Sub-Ledger |

|---|---|---|

| Brokerage | The brokerage control account stores summary balances of open (accrued but unpaid) Brokerage Programs. When sales transactions, that include a Brokerage Program are posted, the brokerage payable (liability) is posted to the Brokerage Control Account and the details are written to the Broker Balances sub-ledger in the Sales Programs functional area. When Brokerage Program Settlements are posted, the brokerage payable balance moves to an accounts payable balance and the details in the brokerage balances sub-ledger are moved to the Vendor sub-ledger. | |

| The sum of the current period balance for all GL Accounts assigned with a 'Brokerage' Control Account Type. | The total of the 'Program Balance' column on the Program Balances page for all the 'Brokerage' programs. This only works if there are no transactions with a date that exceeds the month you are closing. | |

| Checkbooks | The Customers control account stores summary balances of open (unpaid) Sales transactions. When sales transactions are posted, the accounts receivable (Debit) is posted to the Customer's Control Account and the details are written to the Customers sub-ledger. When a customer payment is posted, the Customer's Control Account is credited and the details in the customer sub-ledger are updated to reflect the payment. | |

| The sum of the current period balance for all GL Accounts assigned with a 'Checkbook' Control Account Type. | The sum of the 'Checkbook Amount' column in the Checkbook Transaction Inquiry for each checkbook assigned to the same 'Cash Account' (Checkbook Control Account Type) when either the [GL Period To] or [GL Date To] parameter is set to the last day of the Fiscal Period you are closing. | |

| Customers | The Customers control account stores summary balances of open (unpaid) Sales transactions. When sales transactions are posted, the accounts receivable (Debit) is posted to the Customer's Control Account and the details are written to the Customers sub-ledger. When a customer payment is posted, the Customer's Control Account is credited and the details in the customer sub-ledger are updated to reflect the payment. | |

| The sum of the current period balance for all GL Accounts assigned with a 'Customers' Control Account Type. | The sum of the 'GL Account' subtotal for each Customer Control Account on the Customer Aging report when the report is run through the last day of the Fiscal period being closed and grouped by GL Account. | |

| Fishermen | The Fishermen control account stores summary balances of open (unpaid) Fishermen transactions. When Fishermen transactions are posted, the Fishermen's control account is either debited or credited, based on the transaction type, and the details are written to the fisherman sub-ledger. When a payment that was either made or received from a fisherman is posted, the fisherman balance is updated and the details in the fisherman sub-ledger are updated. | |

| The sum of the current period balance for all GL Accounts assigned with a 'Fisherman' Control Account Type. | The sum of the 'GL Account' subtotal for each Fishermen Control Account on the Fisherman Aging report when the report is run through the last day of the Fiscal period being closed, run for only 'Fisherman Classes' assigned to Fishermen & Tenders (not Fisherman Loans), and grouped by GL Account. | |

| Fishermen Loans | The Fishermen Loan control account stores summary balances of open (unpaid) Fishermen Loans. When Fishermen Loan transactions are posted, the Fishermen Loan's control account is either debited or credited, based on the transaction type, and the details are written to the fisherman Loan sub-ledger. When a payment that was either made or received from a fisherman loan is posted, the fisherman loan balance is updated and the details in the fisherman loan sub-ledger are updated. | |

| The sum of the current period balance for all GL Accounts assigned with a 'Fisherman Loans' Control Account Type. | The sum of the 'GL Account' subtotal for each Fishermen Loan Control Account on the Fisherman Aging report when the report is run through the last day of the Fiscal period being closed, run for only 'Fisherman Classes' assigned to Fishermen Loans (not Fisherman & Tenders), and grouped by GL Account. | |

| Growers | The Grower control account stores summary balances of open (accrued but unpaid) Grower balances. When grower Tickets are posted, the grower balance is posted to the Grower Control Account and the details are written to the Grower Balances sub-ledger. When Growers are paid, the grower balance is debited, and the details in the grower balances sub-ledger are updated. | |

| The sum of the current period balance for all GL Accounts assigned with a 'Growers' Control Account Type. | The sum of the 'GL Account' subtotal for each Vendor Control Account on the Vendor Aging report when the report is run through the last day of the Fiscal period being closed, run for only 'Vendor Classes' that are Growers, and grouped by GL Account. | |

| Rebates | The Rebates control account stores summary balances of open (accrued but unpaid) Rebate Programs. When sales transactions, that include a Rebate Program are posted, the rebate payable (liability) is posted to the Rebate Control Account and the details are written to the Rebate Balances sub-ledger in the Sales Programs functional area. When a Rebate Program Settlement is posted, the rebate payable balance moves to either an accounts payable or accounts receivable balance and the details in the rebate balances sub-ledger are moved to either the Vendor or Customer sub-ledger (depending on whether the Rebate Program's Payee is a customer or vendor). | |

| The sum of the current period balance for all GL Accounts assigned with a 'Rebates' Control Account Type. | The total of the 'Program Balance' column on the Program Balances page for all the 'Rebate' programs. This only works if there are no transactions with a date that exceeds the month you are closing. | |

| Vendors | The vendors control account stores summary balances of open (unpaid) Payable transactions. When payable transactions are posted, the Vendors Control Account is credited, and the details are written to the vendor sub-ledger. When payments are made and posted, the vendor payable balance is debited, and vendor sub-ledger is updated. | |

| The sum of the current period balance for all GL Accounts assigned with a 'Vendors' Control Account Type. | The sum of the 'GL Account' subtotal for each Vendor Control Account on the Vendor Aging report when the report is run through the last day of the Fiscal period being closed, run for only 'Vendor Classes' that are NOT Growers, and grouped by GL Account. | |

Mark the Fiscal Period as Closed

Once everything above is in balance, the Fiscal Period must be "closed" by navigating to the Fiscal Year Record View and checking the 'Closed' checkboxes for the appropriate GL Period row. This can be done by navigating to Financial → Configuration → Fiscal Periods and selecting the appropriate Fiscal Year page.